Ava Zadkhorvash and Jon Hart of award winning law firm Pinsent Masons LLP take a look at potential funding models for highways infrastructure, Regulated Asset Bases and life after PFI and PF2.

Spare a thought for our Treasury civil servants and policy makers. Every now and again, they may be reminded of a time when they turned up for work and the key issue of the day was not Brexit.

Outside the hurly-burly of deal/no-deal, rogues and proroguing, from time to time, other imperatives occasionally rise to the surface, including coming to terms with the state of the UK's infrastructure and how it is going to be paid for.

According to various sources, more than £600bn is due to be invested in infrastructure over the next 10 years, with the Government deciding that around half of the planned investment should come from the private sector. So far, so staggering.

However, there are some gaps in the picture as to what role the private sector may be required to play and how.

The end of PFI?

Less than 12 months ago, a previous chancellor called time on the PFI and PF2 model, particularly the use of the design-build-operate and maintain structure (DBFOM). Under DBFOM, a single consortium would be appointed under a long-term (typically 25 to 30 years) contract, to build a new asset using private debt, and then to operate and maintain it.

The majority of construction risks would be borne by the consortium, flowed down to a design and build contractor, which sometimes would also be an investor in the consortium.

Operational risks would be borne by an O&M contractor and levels of payment to be made by the public sector would be geared to how well the asset performed in practice, measured by a complex contractual mechanism which, depending on individual contracts, would take account of factors such as lane closures, journey times and safety performance.

In a very limited number of cases, the model is adapted to provide that payments to a consortium will be made from a revenue stream (for example tolls) on a ‘concession' or ‘demand risk' basis.

DBFOM and its variants lay at the heart of PFI and PF2. In its time, it has been used to build hospitals, schools and housing. In the highways sector, it has been perhaps less widely adopted, but has been used to deliver schemes such as the A1 Darrington-Dishforth scheme and the M25 road widening for the Highways Agency, as was.

There have also been a few examples of concessions – notably the M6 Toll Road. Certain local authorities have used this model for delivery of streetlighting schemes and highway maintenance.

This model and its contractual risk allocation have not been without controversy. On the one hand, there are the examples of Carillion's liquidation, the Aberdeen bypass and Birmingham Highways, which have seen contractors seriously affected by costs and deductions. On the other hand, there have been criticisms from think tanks such as the recent IPPR report into hospitals that there has been poor risk transfer and value for money for the public sector.

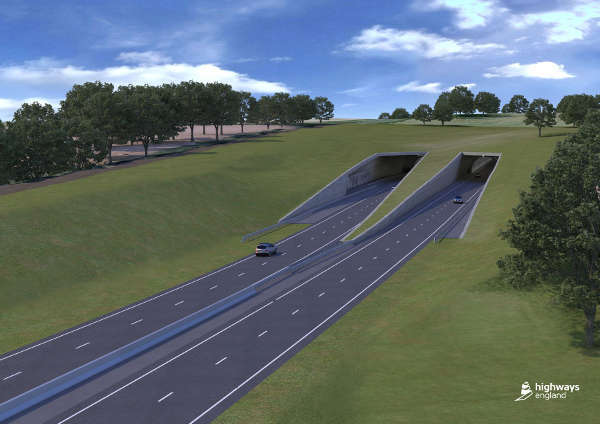

As readers will be aware, in the roads sector, Highways England was in the process of procuring two schemes using DBFOM at the time of last October's announcement - the A303 Stonehenge tunnel (above) and the roads for the Lower Thames Crossing (below). For potential tenderers and investors (some of whom had been tracking the projects for a considerable time) DBFOM's demise came as a bolt from the blue.

That said, the Treasury indicated at the time that it was open to looking at ‘other approaches' for investing in infrastructure, including roads.

In this context, it is also important to mention that the chancellor's pronouncements are limited primarily to England. Both Wales and Scotland are continuing to develop their own project finance solutions, which are similar to DBFOM.

In Scotland, both the M8 and Aberdeen bypass projects have been procured using the ‘Not For Profit Distribution' Model (NPDM), while the A465 Head of the Valleys scheme is being procured by the Welsh Government's ‘Mutual Investment Model' (MIM). Both of these models require a successful consortium to provide design, construction and O&M services with the provision of private finance.

Where next?

So where are we now, 12 months later? In the first instance, there is opportunity to consider dispensing with any form of private finance involvement at all. Apparently the Stonehenge project will now be procured following a more traditional engineering procurement route, making use of the tried-and-tested (and usually heavily amended) NEC Engineering and Construction Contract.

As a procurement approach, this is relatively familiar territory, albeit that it lacks one of the often-overlooked benefits of the DBFOM model, of contractually addressing design and construction issues at the same time as long-term lifecycle and maintenance arrangements.

Perhaps as pertinently, from an investment perspective, consideration would need to be given as to whether this kind of approach may be adapted to provide for the use of external private finance – and if so how.

The scrapping of PFI and PF2 has been accompanied by a range of consultations sponsored by the Treasury. The Infrastructure Finance Review published earlier this year looked at the various private financing models already in use and how these ‘could be applied in new contexts', in a bid to improve the public sector balance sheet, and ensure value for money for the taxpayer.

Regulated Asset Base

The Scottish NPDM and Welsh MIM do not appear to be given particularly extensive consideration, but one alternative, well-established, model being increasingly considered by the Government is the Regulated Asset Base (RAB).

RAB accounted for over £160bn of private sector infrastructure investments in 2018, particularly in the water, gas, electricity, telecoms, (and with some tweaks to the model) railways sectors. There has been a lot of interest in the Government's latest consultation, to see if RAB can be applied to the development of new nuclear power stations post-Hinckley C.

In simple terms, RAB uses the following structure:

- an economic regulator grants a licence (rather than a DBFOM contract or concession issued by a governmental authority) to a private company to operate and maintain an infrastructure asset, providing the company the right to charge a regulated price to users

- the economic regulator is an independent regulator appointed by statute that will set the price and will hold the company to account, ensuring that end-users are not exploited

- demand risk is passed to the company as it charges the end-users of the product or service (e.g. users of water utilities)

- the company agrees to invest certain sums in maintaining and developing the asset by reference to agreed ‘control periods' – the regulator will look at the value of the underlying asset and will also set the weight average cost of capital (and from this the returns that the company might be making)

And how would this model work with the highways sector? Interestingly, although it was not implemented, in 2013 a consultation was launched to introduce the RAB model to the roads sector.

The proposed model suggested that the Government would initially portion for a user charge within motor taxes in order to help fund the operation and maintenance of the roads network. This would then be outsourced to the private sector, thereby, taking the project off-balance sheet from the public purse.

At the time, the CBI expressed concerns that this type of funding would not be sufficient to meet or cover the future investment needs and warned that the use of toll roads would likely have to be introduced.

Currently, the Office of Rail and Road (ORR) operates in a regulatory capacity in relation to Highways England and the strategic road network (SRN). As the ‘Highways Monitor', the ORR enjoys certain enforcement powers to require that Highways England complies with Highways England's statutory licences and road investment strategy (analogous to the control periods mentioned above under a RAB) for the SRN.

The missing element here is, of course, the absence of an ‘end user' in the same way that is the case for, say water utilities: something that was highlighted at the time of the 2013 consultation. Funding for the road investment strategy has been ring-fenced by the Department for Transport (and Treasury).

While the technology for road user charging continues to develop (and certain optimists may say will provide a solution to the difficulties associated with the Brexit backstop for the Northern Ireland border), there is (obviously) no appetite yet for further developing the regulatory model to bring the highways sector closer to a pure RAB. Indeed, given the criticisms that have been levelled against asset holders in the electricity and water sector, some may argue that the likelihood of an RAB model for roads is further away than ever.

And yet… the question of investment remains and when or if the smoke of Brexit clears some of the affected civil servants may be able to get back to their day job of coming up with some possible solutions.

The National Infrastructure Commission (NIC) recently refined its analytical tool in a bid to ensure that the Government considers broader factors such as whole-life and social impact in their infrastructure procurement models.

Based on five road schemes, the pilot trial was inconclusive. It was not possible, nor realistic to evaluate the relevant costs and benefits of private financing and procurement methods traditionally used.

However, Sir NIC chair John Armitt said that: ‘transforming the nation's infrastructure means mobilising private sector investment alongside that of government'.

STOP PRESS: In last month's column, we highlighted the proposed changes to VAT invoicing – the so-called reverse charging – which would potentially have had a significant impact for both main contractors and subcontractors. The Government has listened to concerns from industry and is postponing the reverse charge to 1 October 2020. This will avoid the changes potentially coinciding with Brexit and will give businesses longer to prepare.

There were concerns that SMEs in particular were ill-prepared for the changes. This still means that the issues highlighted about considering changes to subcontracting arrangements and invoicing systems remain a source of legitimate concern – but now there is going to be a longer period of time to raise awareness and be ready for implementation.